Emulsion( presentation) is 13 months down, but will the 14th be the same

Emulsion( presentation) is 13 months down, but will the 14th be the same

While the broader request’s bearishness has clearly impacted the price and growth of emulsion( presentation), a significant donation to the same also comes from dwindling demand. This is easily visible when observing the on- chain statistics of the lending protocol.

emulsion soothed

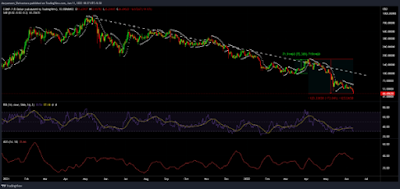

Following the each- time high establishing rally of May 2021, presentation has seen a decline which is continuing indeed 13 months latterly. The altcoin took a major hit back in April after its attempts to transgress and flip the downtrend into support failed. At the time, presentation ended up sinking by 73.

At the moment, the broader request’s bearishness is getting stronger, as visible on the Average Directional indicator( ADX). This pushed the altcoin to the verge of slipping into the oversold zone, recovery from which will be terribly delicate for presentation.

Alas, as delicate as it's naturally for presentation to recover the losses, it is n’t seeing important support from its investors and holders moreover.

All the way down …

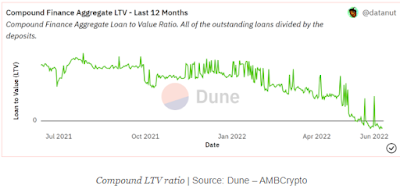

The lending protocol has been facing a gradational decline in the total quantum deposited versus the total quantum lent. Back in December 2021, the Dapp had about$ 19 billion deposited in it and nearly$ 7 billion lent to druggies.

Still, in the last six months, the numbers have come down to just$4.6 billion in deposits, and the outstanding loans are at-$ 200 million.

The loan- to- value( LTV) rate, which principally calculates the rate of all outstanding loans to the deposits, is at-4 now. utmost of the compression in the rate came over the last two months, before which this value stood at 33.

still, investors pulling out of the protocol and the asset does make sense. Especially since they've been constantly losing their gains since May 2021.

A time ago, lower than 3 of addresses fell victims to losses. On the negative, at the time of jotting, investors in losses now dominate 92 of emulsion’s 187k addresses.

The liability of recovery on both ends is only possible if the broader request recovers. Especially since the Dapp’s growth has been rather lackluster of late.

No comments